estate tax exemption 2022 build back better

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022. This means that if you pass away in 2022 and your estate is valued at this amount or more it will be subject to taxes.

2022 U S Tax Legislation Forecast

As passed by the House on November 19 2021 the Build Back Better Act does not include these earlier proposals.

. Without Section 2032A the farmers family would owe about 48 million in estate taxes assuming the personal exemption now 117 million is lowered to about 6 million in 2022 as the Build. But the exemption amount has changed considerably throughout the years. The Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025.

The revised bill makes significant changes to and departures from the tax proposals approved in the September 13 2021 version the September version 1 not to mention brushing aside the Senate Finance Committees Billionaires Tax. In addition to the Washington estate tax there is a federal estate tax you may have to pay but the exemption is much higher. The annual inflation adjustment for federal gift estate and generation-skipping tax exemption increased from 117 million in 2021 to 12060000 million in 2022.

On October 28 2021 the House Rules Committee released a revised version of HR. One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

The proposal would roll back the giftestate and GST lifetime exemptions to one-half the current levels set in 2017 effective January 1 2022. 5376 the Build Back Better Act. The size of the estate tax exemption meant that a mere 01 of estates filed an estate tax return in 2020 with only about 004 paying.

The History of the Estate Tax Rate. The exclusion amount is for 2022 is 1206 million. Federal Estate Tax.

The prior version of the Build Back Better bill included an acceleration of this reduction of the exemptions to January 1 2022. Build Back Better Act. 28 2021 President Joe Biden announced a framework for changes to the US.

Would eliminate the temporary increase in exemptions. The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal Revenue Service inflation-adjusted numbers. Use It or Lose It EstateGift Tax Exemption Cut in Half Effective January 1 2022.

One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021. As we discussed in more detail here Congress previously proposed as part of the Build Back Better Act accelerating the sunset of the exemption to January 1 2022 and essentially halving the exemption to an inflation adjusted 5000000 or approximately 6030000. The federal estate tax exemption is 1170 million in 2021 going up to 1206 million.

A later House of Representatives proposal sought to increase the capital gains tax rate and cut the estate and gift tax exemption in half in 2022. Revise the estate and gift tax and treatment of trusts. 10000000 as adjusted for chained inflation presently 11700000 per person will be intact through the end of 2021.

Due to inflation the estate tax exemption has risen this year to 126 million dollars. The new exemption amount would be 5 million indexed for inflation dating back to 2010. 2022 Annual Adjustments for Tax Provisions.

Under the current tax laws the estate gift and generation-skipping transfer tax exemptions are already scheduled to be cut in half from the current level of 117 million indexed for inflation effective on January 1 2026. The good news on this front is that the reduction of the estate and gift tax exemption from. The federal estate tax exemption for 2022 is 1206 million.

Enacted in the Tax Cuts and Jobs Act TCJA. Importantly that provision was removed and was not contained in the most recent. The estimated 175 trillion bill proposes extending the enhanced child tax credit.

Tax system to raise revenue for a 175 trillion version of the Build Back Better Plan. Transfer tax exemption for lifetime gifts death transfers and generation-skipping transfers. From Fisher Investments 40 years managing money and helping thousands of families.

Skip to main content March 13 2022. Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026. This means that an individual can leave 1206 million and a married couple can leave 2412 million dollars to their heirs or beneficiaries without paying any federal estate tax.

Act BBBA The Build Back Better Act BBBA. The annual rise of exemptions is nothing new. These proposals are currently under consideration by the U.

For married couples the exclusion is now 24120000 million. The tax rate applicable to transfers above the exemption is currently 40. 5376 contains no modifications to the estate and gift tax exclusion amount or the basis step up rules.

Previously this reduction was not scheduled to take place until January 1 2026. On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000. The Build Back Better Act HR.

115-97 increase the limits on certain discounts of value for. Three versions of the Build Back Better Act have attempted to make significant changes to current gift estate and trust income tax law.

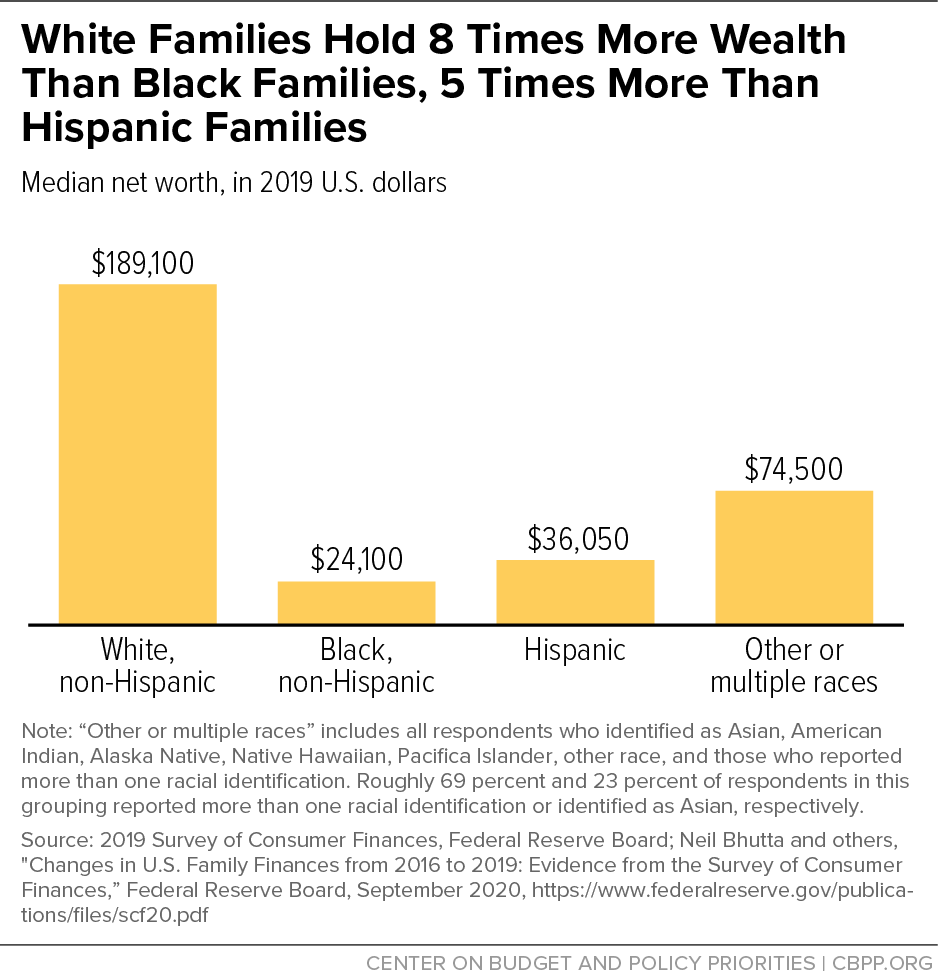

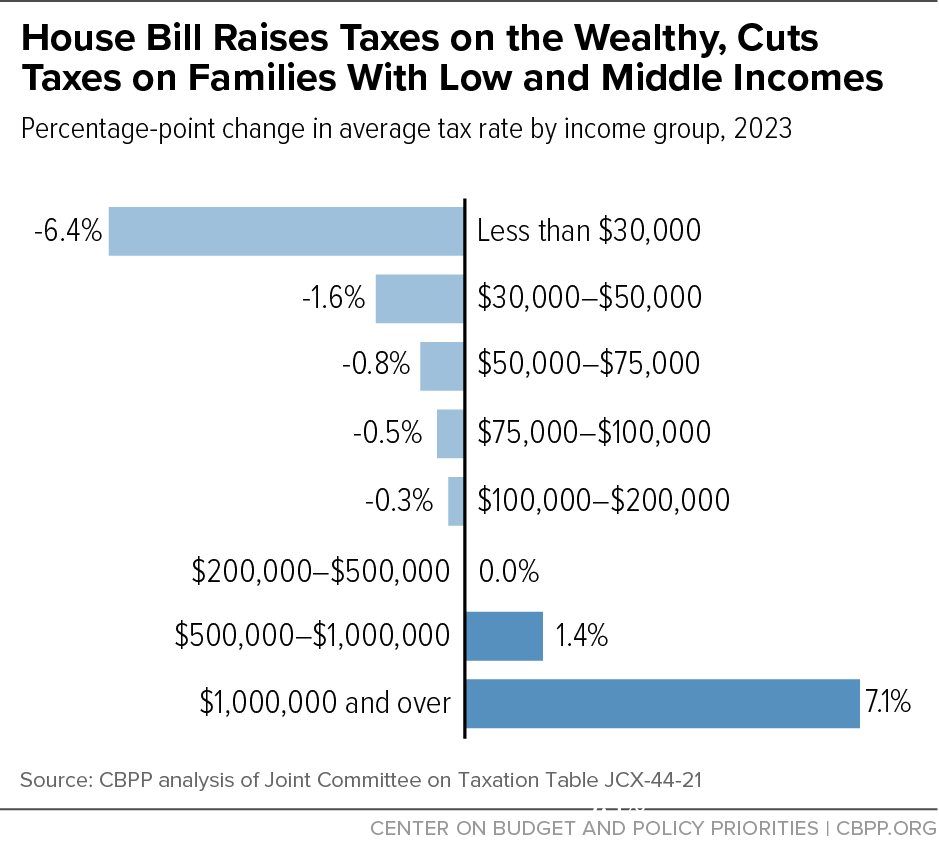

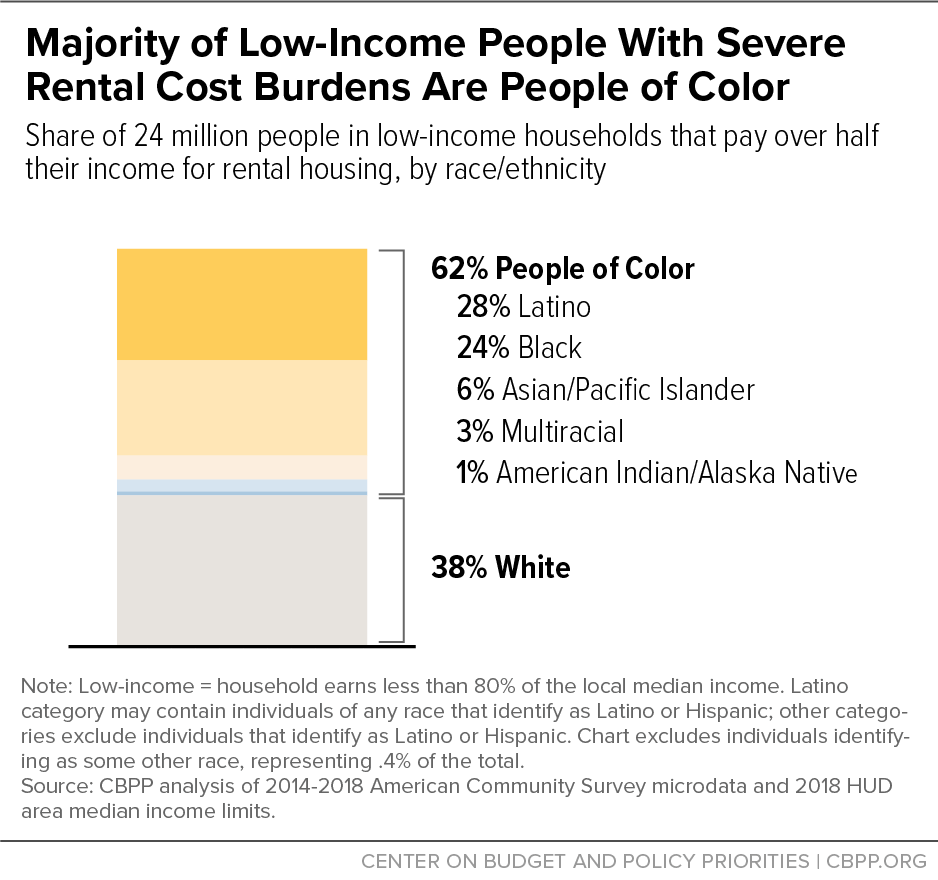

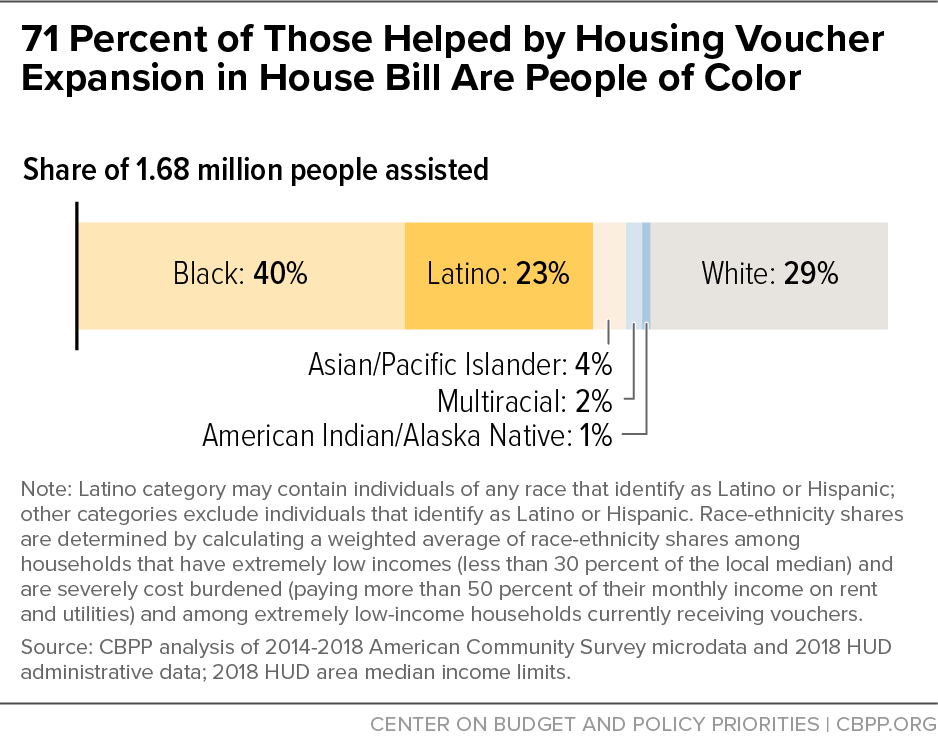

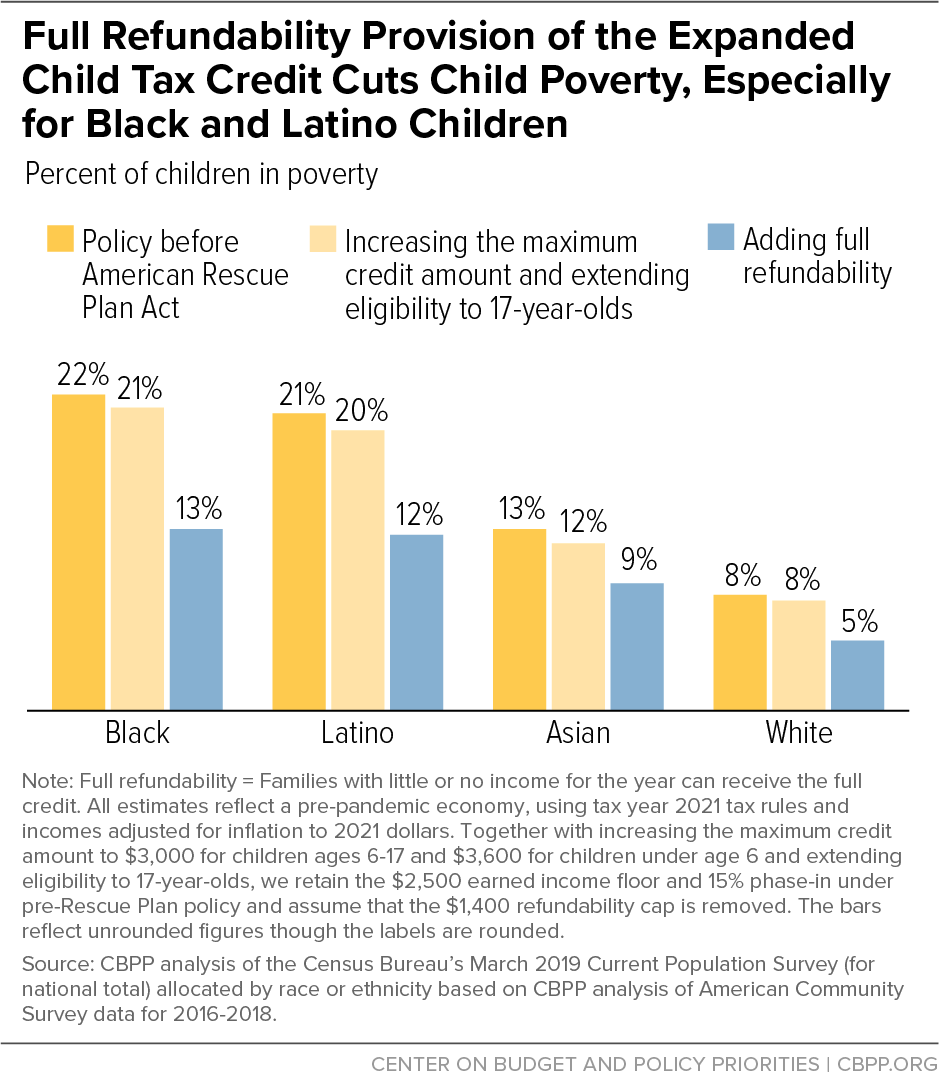

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

Estate Tax Exemption 2022 Definition

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times

Joe Biden Thinks Congress Can Pass Part Of Build Back Better Act

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Tumblr Credit Score Improve Credit Score What Is Credit Score

Tax Return In 2022 Tax Brackets Standard Deduction Estate Tax

How And Why To Get Pre Approved For A Mortgage Preapproved Mortgage Mortgage Marketing Real Estate Tips

Build Back Better May Be Dead But These Key Portions Will Pass Sen Kaine Says

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

With A Smaller Build Back Better Here S What Aid Americans May Expect

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch